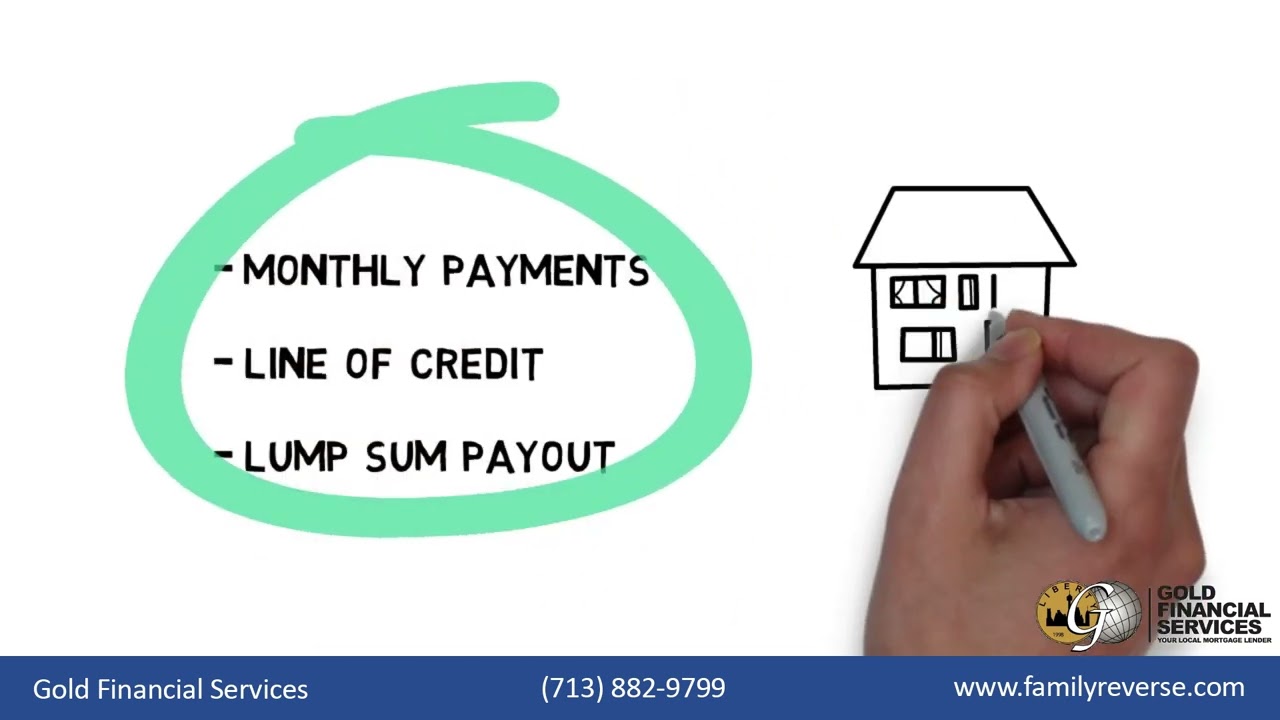

Access your home equity to fund your retirement goals while staying in the home you love. A reverse mortgage allows homeowners age 62 and older to convert equity into cash, improve monthly cash flow, and create financial flexibility for healthcare, lifestyle needs, and long term retirement planning.