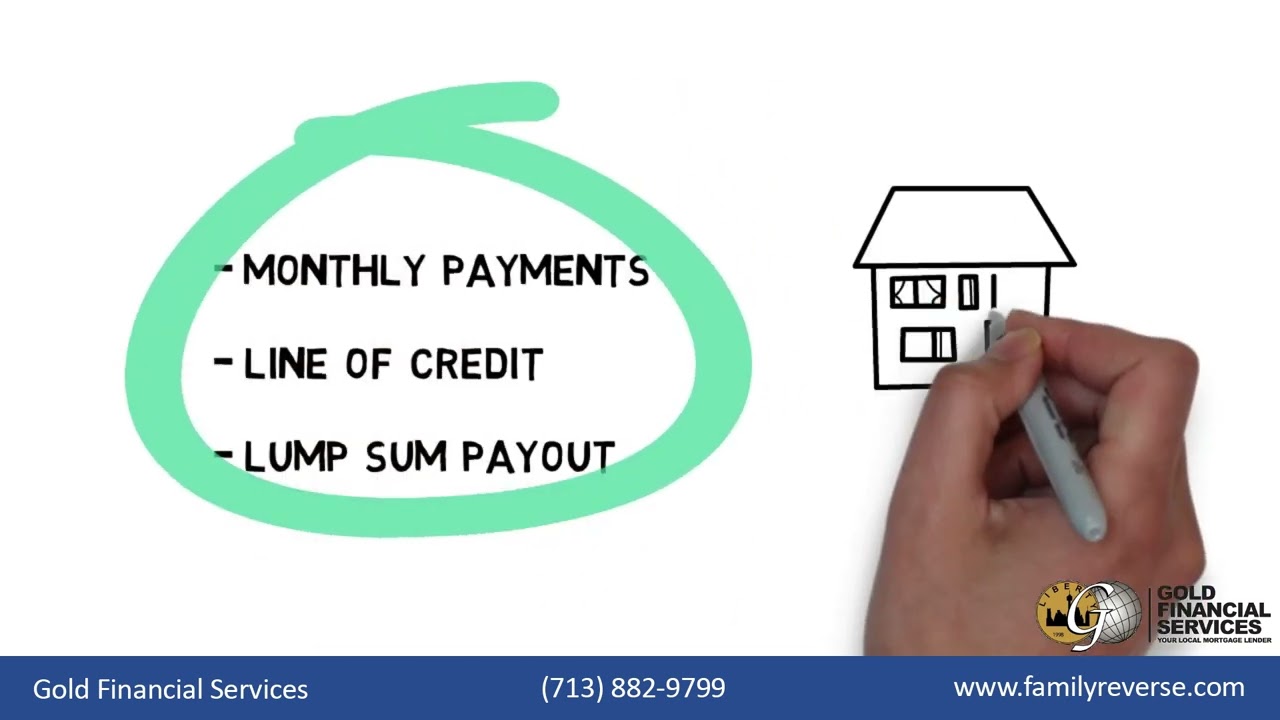

Access more home equity by refinancing your reverse mortgage. If your home value has increased or you want to optimize your loan structure, refinancing may allow you to unlock additional funds, strengthen cash flow, and create more flexibility for retirement expenses, healthcare needs, or long term planning.